For just a moment, forget about your fee recovery plan, and let’s go back just a bit. Do you remember when you started your business or your position?

Do you remember running the numbers or working hard to come up with the best pricing? You understood the market, it’s demand and clientele. You sold a fair product or service, at a fair price.

Because of competition, market contraction, or any other influence, a trend emerged. Not a good trend… A trend of “margin creep”.

Margin creep refers to a slow reduction in profit margin over time.

Sometimes this trend is so slow, we do not notice it until it has already taken a drastic toll on us. A good way to explain how sly margin creep can, you know, creep up on you is weight gain or hair loss.

It wasn’t like I woke up one day and was 30 pounds heavier. Or that out of nowhere, I had thin hair. It happened over time. It happened in a slow manner and was so easy to stop if we were only paying attention.

“… woke up one day and was 30 pounds heavier…”

If I only practiced social distancing with my fridge during COVID-19 lockdown…

A compliant fee recovery plan is one of the easiest, fastest, and most accepted way to combat margin creep. Keep in mind, the success of your fee recovery efforts is only as good as the execution of your plan.

In this guide, I will layout a 90-day plan fee recovery plan to have a successful launch of your compliant cash discount or compliant surcharge program. We will cover the following:

- Pre-Launch

- Notification of Intent

- Staff Training

- Day 1

- Clear and concise messaging to the customer.

- Never surprise your customer.

- Proper signage with brief explanations that the customer can relate to

- Training for empathy, not attitude when handling questions or concerns.

- Day 30

- Report

- Day 60

- Measure

- Day 90

- Learn

Before I go too far into detail, if you are a local business creating a fee recover plan, please leave a comment below. Write ”Yes“ if you are and “No” if you are not. You can write more, of course, we would love to see it. I want to use these results for a future guide.

Pre-Launch

Before you launch your fee recovery plan, you will want to build your foundation.

The foundation of your plan is what plants the seed for success. If you skip these steps, you can be sure you will struggle.

One of my favorite quotes, when I want to prepare for success, is by Bobby Unser. From what I gather, he is the one who coined the phrase: “Success is where preparation and opportunity meet”.

“Success is where preparation and opportunity meet”

Notification of Intent

If you did not read our last post about the rules, guidelines, and how to implement, I do recommend that you do. One of the most important parts is the compliance, one of which is the notification to the card brands. Check it out here. Although it is titled “How to Implement a Credit Card Surcharge Program“, it also applies to Cash Discounting as well.

If you are doing a compliant surcharge program, you will need to notify Visa, MasterCard, and your processor at least 30 days prior to the day you take your first surcharge.

The easiest way to do this is to fill out the online forms.

Visa and MasterCard each have a form that merchants must fill out and submit. You can find Visa’s here and MasterCard’s here.

To alert your processor, the easiest way is to contact your merchant representative. If you have trouble reaching your rep, their general support will be the next place to go.

Staff Training

Messaging is by far the most important part of a successful fee recovery launch.

We will get into exactly what kind of messaging and some great examples a bit further into this guide.

I mention this now because messaging is only effective if delivered with care.

We both know that you can not always be there to help the customer through this transition. The transition from paying for their rewards to passing on the fees.

You will need to work with your staff to help them deliver a consistent message. This message is that the transition is in everyone’s benefit. The goal is that they walk away feeling that they would make the same decision, and that they should support you.

We recommend working with the staff on the following:

- Why do we have this fee recovery program?

- This is in everyone’s benefit. They need to understand and feel it.

- How to respond when someone questions, comments or complains about the program.

- How to be empathetic when dealing with a customer.

- Not everything is set in stone.

We recommend role-playing with your staff. It goes a long way and builds confidence. If a staff member is confident, this usually goes with little to no resistance.

Why do we have this fee recovery plan & what are the benefits?

We recommend that you help your staff understand the motivations behind this. Usually this is because we have experienced heavy margin creep.

Try to include other benefits as well. Help them understand how having a fee recovery program can prevent future increases.

It levels the playing field for those who pay with cash. Cash buyers are often subsidizing the costs caused by reward cardholders.

The fact is, now that COVID-19 is here, our customers are more than willing to help us get back on track. Back on track to providing service for years to come. They are willing to help bear the cost, or use a more affordable method such as cash.

How to respond to questions or concerns and not everything is set in stone.

James Shepard of CCSalesPro.com, an expert on fee recovery programs, weighs in. He finds an increase in questions or concerns within the first 30 days of implementation. He states this is usually 1-3%. However, after the first 30 days, that percentage usually settles to 1% or less.

This may not seem like a lot with 1-3 complaints for every 100 transactions. If a merchant does 100 transactions per day, the idea of 1-3 complaints per day can weigh heavy on your staff. After 30 days this dwindles down fast.

There is an easy way to combat this though. James is right when he points out that the first part is to have realistic expectations for you and your staff. Expect a few complaints, but this does not mean you will lose them as customers. It just means they need to adjust to the change.

They need to understand that as costs rise, they always do, this can keep prices reasonable. It is a necessary step. Plus, this change does not apply to everyone! It only applies to those who continue to use cards. If you have a customer who is less than happy about the change, they are welcome to use with cash and avoid any changes.

But how does your staff relay this the way you would?

They need to have empathy. They need to understand that it is not necessary for the markup that is upsetting the customer.

Maybe they are feeling tricked or unfairly targeted? If your staff can put themselves in the customer’s shoes, it can go a long way.

Roleplay with them. “Yes Mr customer, I see how having the extra $0.35 added to the charge seems unfair. But if it is ok, I would like for you to see why this is actually a step that prevents future increases. Plus, please remember, we always have a no-cost option, you can use cash.”

This is where it helps to have a hand back that goes to the customer. We will work on helping you create material for this.

Now, there is the rare case where a customer might not have any choice. Maybe they only have a credit card and do not have cash. It is important to understand that having empathy is not wrong or weak. If there is a rare case, it is good to have a plan for when you may want to waive the surcharge or noncash adjustment. Some do this by pulling cash out of the register to cover the markup.

Day 1

Congratulations, you are on day 1. You have laid out the foundation, trained your staff and you have the right expectations.

So what do we have to do starting today to make this 90-day fee recovery plan a success?

Clear & Concise Messaging

Follow the below for tips on being clear and concise.

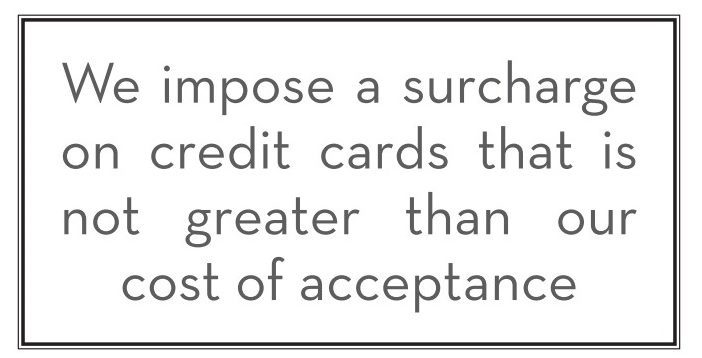

Proper Signage

As stated in the previous article, post signage at the entrance and at the point of sale.

If you do not have an entrance such as a kiosk, post above the checkout register. If the point of sale and the entrance are the same point, one notification may be used. In cases like this, we recommend a verbal notification with the option to opt-out. The SurChoice iOS app prompts for a verbal notification prior to each sale.

Example of a verbal notification: “Your total today is $11.35. Would you like to save $0.35 today by paying with cash or debit? Your total today would only be $11.00 with this discount”.

Make sure your signage is clear and concise. It should not be small font, nor worded in a way that is misleading.

No Surprises

Customers do not want to feel like they have been tricked. Be honest with them, show them the signage, and explain when necessary. You will be surprised how many understand this.

Empathy, Not Attitude

There is the rare occasion where a customer might be upset or threatening.

Remember, to remain calm. Listen to their concern and empathize.

They have a real reason why they are upset. It is true that maybe your $0.05 added to the bill may not be the real reason that they are mad, but it may be the trigger.

They need to feel heard. Do not roll your eyes. Repeat back to them their concern. Try to remember a time where you felt the same and can relate to them.

Explain how this solves a problem the impacts a lot of businesses and there is an easy way to avoid this issue, it is to pay with cash. If they point out that they want their rewards or points, often they do not understand that you as the business are the ones who pay for these rewards. Often after they hear that they do a complete 180.

So do not have an attitude or stoop to their level if they are being less than nice. But do try to understand where their frustration comes from. And remember, it is only temporary.

Day 30 – Report on your Fee Recovery Plan

Congratulations, you made it 30 days.

- What did you find? Let’s take time to reflect and report back what we have experienced so far.

- Did you find the implementation of your 90-day fee recovery plan to be as tough as you expected?

- How did repeat customers react after the first week or two?

Now that you see the benefits are starting to take place, let’s keep a close eye out for the next 30 days. The next 30 days are where we are going to measure for the next phase.

Day 60 – Measure your Fee Recovery Plan

- Did your margin increase over these last 60 days?

- What percentage did it increase?

- Did you lose more than a few customers? Did the margin increase outweigh the loss or did the loss outweigh the increase?

- What are you doing with the increased funds in your account? Are you using them to market or increase your offering?

Day 90 – Learn from your Fee Recovery Plan

Wow, 90 days passed.

- What have you learned?

- Is there anything that you would do differently for the next 30 days?

- What have you learned over these last 90 days that you would change?

- How would you design this plan differently for the next business that takes this task on?

Conclusion

In conclusion, 90 days is an important time frame for the success of your fee recovering program. It sets the tone with your customers.

Your intentions are not to penalize for paying with a credit card. It is a method of keeping the costs low for all payment types, including credit cards.

In summary, a successful fee recovery plan has the following in common:

- Pre–Launch

- Notification of Intent

- Staff Training

- Day 1

- Clear and concise messaging to the customer.

- Never surprise your customer.

- Proper signage with brief explanations that the customer can relate to

- Training for empathy, not attitude when handling questions or concerns.

- Day 30

- Report

- Day 60

- Measure

- Day 90

- Learn

Following the above guide will ensure success for your business and your customers.

Did I leave anything out? How did your fee recovery plan launch go?

Questions or comments?

Please say so below. Your engagement motivates us on our writing and guides us on what topics you find most helpful.