If you are familiar with the merchant services industry, you may know that we make our income on the amount of bankcard volume a location takes in.

What does this mean? This means that the more a business takes in on credit or debit card, the more money we make.

What I am about to tell you goes against what most of the sales professionals, networks, and independent sales organizations want me to admit.

They do not want this out as in their mind, they will make less money and so will their partners. It is my belief that this is not true at all. In fact, we can help the merchant save money and still make a great living while we do it.

Look, those of you who know me, know that I will always put people first. This doesn’t mean that the customer is always right. It means that the person is always more important than the return.

This is where a credit card surcharge program comes into place. Surcharging not only makes sense, it is not that hard to implement.

It is true that there are some complex rules that govern any credit card surcharge program. But we hope that does not deter you as there are many advantages to a fee recovery program.

In this guide, we are going to touch on the rules and regulations. Plus who banned surcharges, then unbanned them. And some tools that will make your fee recovery program easier to put in place and to reconcile.

Here is a brief list of the rules and guidelines if you are implementing a credit card surcharge program:

- Notify the card brands and your credit card processor, at least 30 days in advance.

- Do not exceed the cost of your merchant processing or 4%.

- Signage must be posted, clear and conspicuous.

- The surcharge needs to be disclosed on the receipt as a line item.

- You cannot surcharge a debit card, even if the customer runs the card as “credit”. Why the surcharge rules were created

- A convenience fee and a surcharge cannot be charged on the same transaction

- A brand-level or product-level surcharge can be implemented, but not both.

- When refunding a transaction, the full or prorated amount of the surcharge must be returned as well.

- In the event of a chargeback, the surcharge is also to be returned.

- A surcharge and the base amount must be charged in one single transaction

- A surcharge may not be applied to a customer who is in a state where the state has a no-surcharge law.

- You cannot surcharge a transaction that originates in an area where surcharges are prohibited.

Sounds simple enough, but if it is not done properly, you and your business might face heavy fines and penalties. So let’s do it right.

Note, this guide is only for surcharging. There will be a separate guide for cash discount programs.

Before I go too far into detail, if you are a local business who is implementing your own surcharge program, please leave a comment below. Write ”Yes“ if you are and “No” if you are not. You can write more, of course, we would love to see it. I want to use these results for a future guide.

The Settlement That Empowered Merchants

There is actually a lot of history behind the credit card surcharge, and overcoming the strict rules of non-disclosure. It actually started back in 1968 with the Truth in Lending Act (“TILA”). The TILA, designed to protect the right of merchants to have dual-pricing systems.

“Card issuer may not, by contract, or otherwise, prohibit any such seller from offering a discount to a cardholder to induce the cardholder to pay by cash, check or similar means rather than use a credit card.”

It went through a few twists and turns, eventually the ban was renewed in 1981. Fast forward to 2005. According to Scott Blakeley, Esq. & Brad Boe in an article posted on NACM Southwest:

“In 2005, a pet-relocation company located in Atlanta, Georgia, became the unlikely catalyst to the downfall of surcharge prohibitions”.

It took a long time, but after eight years of litigation, the merchants had won. Visa and MasterCard agreed on a national class action settlement. In January 2013, for the first time in almost thirty years, merchants regained the ability to control a major cost of doing business. You can view more about the settlement here. A quick glance at the document list, it shows dates until recent, that is how intricate this settlement.

There were specific rules put into place.

The Ban of the Ban

There is a full summary of the 2013 settlement and rule changes on MasterCard’s website.

Even though the high courts approved this measure, not every state agreed. Shortly after the decision, states began to install no surcharge laws of their own. There were ten states in total that passed their no surcharge program law, these states were:

- California

- Colorado

- Connecticut

- Florida

- Kansas

- Maine

- Massachusetts

- New York

- Oklahoma

- Texas

Over the next couple of years, merchants began taking a stand. They were challenging the state’s no-surcharge laws. One by one they started to be overturned.

In 2015, Italian Colors Restaurant v. Harris paved the way for the downfall of the surcharging ban in California. According to Foley and Lardner LLP, California district court agreed with plaintiffs and, on March 25, 2015, declared that Section 1748.1 was an unconstitutional restriction of speech because it was a content-based commercial speech restriction that could not survive intermediate scrutiny.

Also in 2015, Dana’s Railroad Supply v. Bondi declared Florida’s no-surcharge law as unconstitutional.

In 2018, Texas dropped theirs after Rowell v. Paxton.

In 2018, one of the biggest ones was New York, Expressions Hair Design v. Schneiderman. New York was one of the last places that the ban was expected to fall.

As of today, there are only 4 states that still have no surcharge program laws.

- Colorado

- Connecticut

- Kansas

- Massachusetts

New York, Maine, and Minnesota have opened up the rules but wherever you post prices, it must be the credit price rather than the cash price.

The Rules and Regulations of Credit Card Surcharges, in Detail

Below are the rules, in no particular order.

Notification Requirements

You must notify the card brands and acquirer in writing, 30 days prior at minimum.

Visa and MasterCard each have a form that merchants must fill out and submit. You can find Visa’s here and MasterCard’s here.

To alert your processor, the easiest way is to contact your merchant representative. If you have trouble reaching your rep, their general support will be the next place to go.

Surcharge Amounts Are Capped

When implementing a surcharge program, there are 2 caps to be mindful of. Don’t charge more than your average cost of acceptance and never exceed 4%.

The general idea is you cannot profit from this surcharge. This means after you collect the recovery fee, the net should be no more than if you sold as cash.

Let’s look at an example: If your cost of acceptance was on an interchange-plus pricing, and you take a credit card that has an effective rate of 2.95%, you cannot charge 4% to the customer. This would be profiting from the surcharge and that is not allowed.

What if you do not know the cost of the card until your statement comes at the end of the month? That is ok, you may take your average cost of acceptance to set your surcharge rate.

An example of the above would be if you took a Signature card for 1.70% and a rewards card for 2.95%. It is ok to take the average of the two and pass on a fee of 2.32%.

There is one caveat to the above, even if your cost is higher than 4%, you still cannot exceed 4% to the customer.

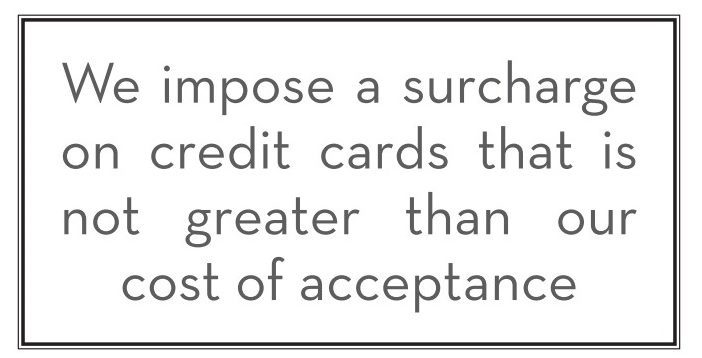

Clear and Conspicuous Signage

You must alert the customer of your surcharge program at the point of entry and at the point of sale.

You cannot catch a customer of guard. Some states have strict laws about deceptive pricing, California for example. You are free to create your own signage. Make sure to give the customer an opportunity to opt-out and choose another payment method.

The card brands provide signage that you can use. It must disclose that the surcharge does not exceed the cost of acceptance.

For e-commerce transactions, the notice must be on the first page. This should be the same page that references the card brands.

Surcharge on Receipt

The amount of the surcharge must be itemized on the receipt.

Example, if there is a $10 transaction and there is $0.40 surcharge, it needs to list out as:

- Base Amount: $10.00

- Surcharge Amount: $0.40

- Total Charge: $10.40

There is also a rule from the card networks to pass information about the surcharge in the approval and settlement. However, it is often viewed that it, if the merchant does not have this ability with their technology, following the rest of the rules, is sufficient.

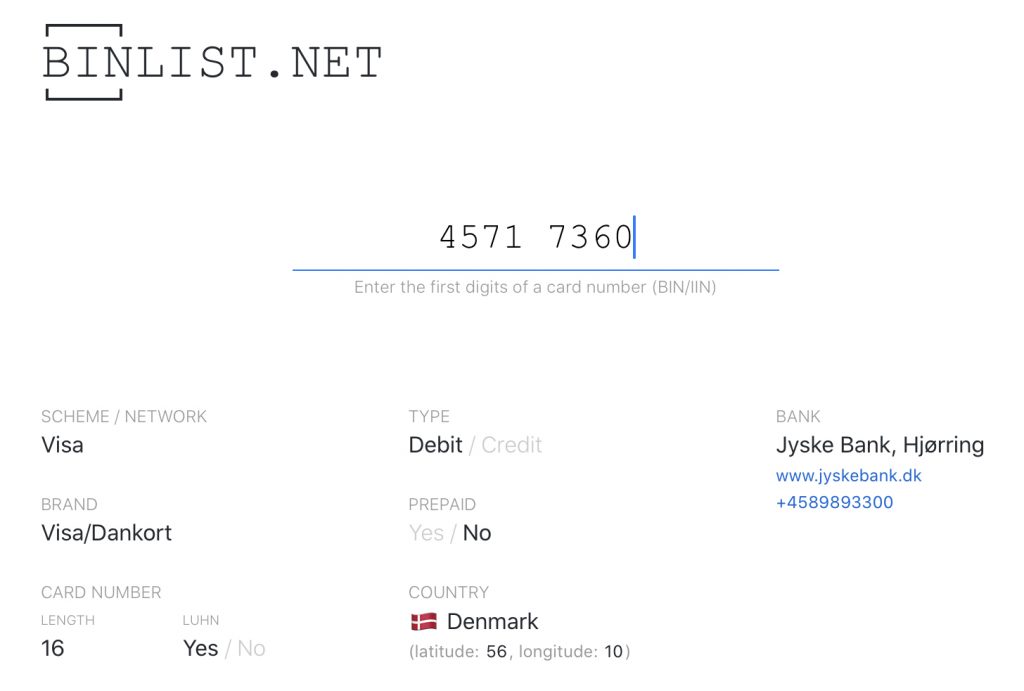

No Debit or Prepaid Cards

According to the card brands and the settlement, you can only surcharge a credit card. You cannot charge a debit card or a prepaid card.

This poses a major challenge when implanting your own credit card surcharge program. This is because many merchants.

The reason this poses a challenge is that debit cards are often mistaken for credit cards. They do bare the debit identifier on the front of the card. The issue is that many clerks may not notice the identifier since it may also bear the Visa or MasterCard logo.

Merchant reps will often set up the merchant accounts with credit and signature debit. Since the cards generally have a major card brand logo, it doesn’t need a pin pad. Swiping it as credit will still debit their bank account. The customer often chooses the credit button to avoid being prompted for a PIN number.

Even if the debit card is run as a credit, you still cannot charge a surcharge.

You will need the ability to filter out the debit cards. Either you or your employee is really good at checking, or you may use technology to help you.

If you are doing e-commerce, you will definitely need technology that can check the card type. If it is debit, the software needs to remove the surcharge.

I recommend that you check the card before it goes through its authorization. This is important and in my opinion, a requirement of a responsible merchant. This is not only to prevent a potential chargeback or complaint, but to protect your customer. If you do a pre-authorization to check the card type, then the real transaction, you risk locking up the customer’s available funds. They may need access to those funds to feed themselves, locking it up over a surcharge is not ok.

There are some good tools that can help with this, I will list them out below under “tools”.

Again, make sure that you do not charge a surcharge on a debit card.

Sometimes this means you may have to “test” the system with your own debit card.

According to an article on CardFellow, a merchant can be fined $1,000 per occurrence, increasing to $5,000, $10,000, and $25,000 per occurrence for repeated violations.

Do Not Combine a Surcharge With Another Type of Fee Recovery

If you are going to surcharge a transaction for using a credit card, only the surcharge can apply.

This means that if you have a surcharge, you cannot add a convenience fee or non-cash adjustment to the same transaction.

This is especially valid for those who are doing e-commerce. If you are doing online, most of your transactions are going to be paid with a card of some type. I would suggest choosing the surcharge method. This way, if a customer pushes back, you can still capture the sale by presenting a no cost debit card option.

A Brand-level or Product-level?

Most of the card brands allow you to do a brand level surcharge, or you can do a product level surcharge. But you cannot do both.

The most common is a brand level surcharge. This means all cards in that brand get the same surcharge, unless it is a debit or prepaid card.

Friendly reminder, all card brands insist that you to treat them equally. If you are applying a brand level surcharge to one card brand, you need to apply a brand level to all card brands. If you accept all card types, you cannot charge a surcharge on a Visa but not on a MasterCard.

A product-level surcharge applies the fee to a particular card type of Visa or MasterCard. For example a Visa Signature card or a World Elite MasterCard. It is difficult to surcharge at the product level and it is not practical for most merchants.

Refunds & Surcharging

When a transaction requires a refund, you must to return the surcharge that you collected back. It is ok to prorate if it is a partial refund.

For example, if you do a full refund on a $10 item, the total was $10.40 with the surcharge, you need to return the full $10.40.

When doing a partial refund, this takes a bit of math. You need to return the surcharge at the prorated amount. If you are giving back $5 of a $10 item, which is 50% of the original transaction, you need to refund 50% of the surcharge, $0.20.

A good software can take care of this for you.

No Separate Transactions

The card brands do not want to see 2 transactions for one sale or donation.

This means when you run the transaction, combine the base with the surcharge.

For example, if the transaction is $10.00 and the surcharge is $0.40, capture the full $10.40 as a single transaction. Do not do one transaction at $10.00 and another at $0.40.

When a customer looks at their credit card statement, they should only see a single authorization for the total amount.

Surcharge Only Where Not Prohibited

If receiving an order from a different state, be sure that there isn’t a no-surcharge law at their location.

If your business operates out of a state that does not allow surcharging. You may face legal penalties.

Useful Tools to Help You with Your New Surcharge Program

Signage

Retail location will need at least 2 printed signs, one at the point of entry and one at the point of sale.

If you go to Google, there is no shortage of sign examples. We like ours to be simple and official. This is why we point our clients to card brand websites for official surcharge signage. Visa has a really good one that you can get here.

Bin Lookup services

A BIN is the beginning part of a credit or debit card. It tells you a lot of useful information.

With the BIN lookup, you can tell a lot about a card. You can see which card brand, network, credit, or debit, if it is prepaid, which country and what bank issued the card.

My favorite tool for this is BINlist.net.

When taking a large transaction over the phone or internet, I recommend checking the BIN first. Go to binlist.net and enter the first 6-8 digits. If it is a debit or prepaid, do not add the surcharge. If it is credit, you should be in the clear as long as you follow the rules.

Invoicing

Many accounting systems have invoicing as an option.

We often recommend this in combination with a hosted payment page. This is because fee recovery is not supported by most of the popular accounting software.

We like Wave for invoicing.

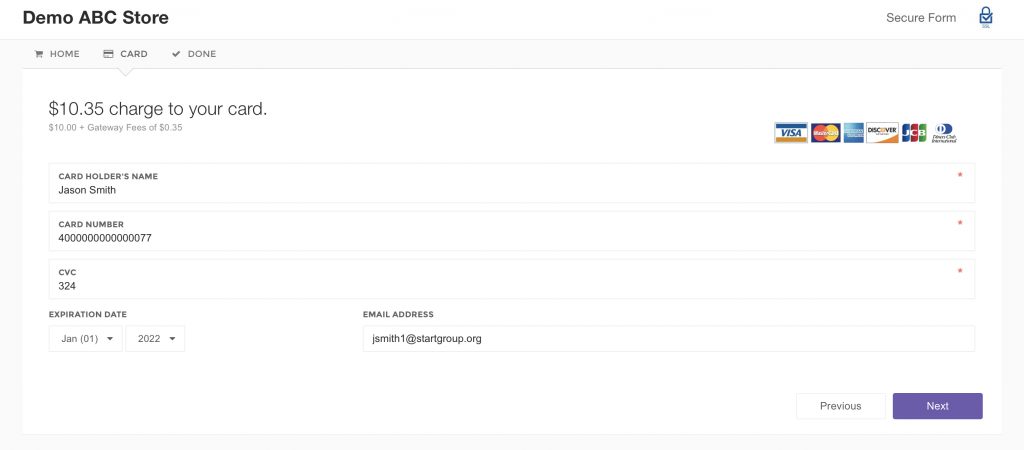

Hosted Payment Pages

Hosted payment pages are awesome and very much underutilized.

There is a known barrier for small businesses who want to make transactions online. It often involves developers who often overcharge. Setting up a website is quite easy now that we have WordPress. But implementing a shopping cart, SSL encryption certificate, and automation can be daunting.

A hosted payment page takes care of all that for you, especially the security part which is what I love. It removes you from the PCI scope (this does not mean a processor will relieve you from PCI compliance).

Look at these as a blank payment form for your business that is hosted by your processor. You can send the link by email, on your invoice, in a letter, a text message, or put as a link on your website.

We find this to be a great option for commercial rent, donations, or for small businesses.

There is a new use case that I was not expecting. It seems that there are some it to collect in-person payments, while social distancing during the Coronavirus pandemic.

The most creative use case that I saw recently was a large QR code in the front of the take out restaurant. They asked customers to please pay their total by scanning the code on the door.

My favorite tool for this is PayNow.io. They provide a hosted payment page that has a fee recovery program built-in, which is very unique. It works great on mobile and is super easy for clients to set up. At the time of writing this guide, they are giving the pages away free to help with those affected by COVID-19.

Hand-Backs

While I do not have a 3rd party source to refer you to on hand-backs, I like to recommend creating them on your own.

Customers rarely complain or question the surcharge nowadays. It has become more common. But in the beginning, some of your customers may ask questions on why you are implementing it now. Training your staff is by far the hardest part when it comes to consistent messaging. Having a printout that your employees can hand back to the customer is very useful. It can explain what and why in a positive and consistent manner.

Reconciliation

The final part of this guide is the reconciliation. This is important, not only for understanding your finances but also for your tax reporting.

There are a few things you need to track:

- How many credit transactions

- How many debit transactions

- What your total gross collected is

- What part of that gross goes to pay your merchant fees

- What part is left over

You are accepting a transaction that has a surcharge within it. That transaction as a whole, will incur rates and fees from the credit card processor. And the gross collected is reported on your 1099.

For example, if you did $10,000 in retail and you charged a 4% surcharge. You would have collected $10,400. This means that according to the processor, you need to pay fees on $10,400, and according to the sales tax you took in $10,400.

To make it easier, you should ask your merchant provider for a flat rate. The flat rate should balance out the transaction. Your flat fee should equal the exact amount of the surcharge you charged to the customers.

For example, if you charge $10.00 plus $0.40, total $10.40. You charged a 4% fee. But if your flat rate with your processor is 4%, then your flat rate would be more than the surcharge you collected.

I want to make it easier for you. If you are charging 4%, then you will want to ask your processor for a 3.847% flat rate. You can see the value of this in bigger numbers. Let’s assume you are doing $30,000 in volume. Your surcharge at 4% would be $1,200. Your total would be $31,200. If you have the flat rate, $31,200 x 3.847 = $1,200, which balances you out.

Next, ask your merchant for daily discount / net funding. This is where the fees are taken out of each transaction before it deposits, rather than the end of the month.

If you process $10.00 plus $0.40, total $10.40, they will only deposit $10.00. This saves you from sticker shock at the end of the month and makes reconciliation on the credit cards a breeze.

Each month, you want to make sure that your credit card fees balanced out to zero. You will still pay your debit card fees.

At the end of the day, your margin will greatly increase due to no longer having credit card fees as an expense.

Conclusion

There you have it!

If you are going to implement your own surcharge program, you now know the rules to follow.

There is no doubt that it is complex, but it is completely achievable.

The hardest part of this whole thing, is making sure that your staff follows the steps that you lay out for them.

Did we miss anything?

If you found this post useful, please kindly say so below in the comments. If you did not find it useful, please kindly say so in the comments. Your comments are what gives me the motivation to share knowledge.

Thank you so much!