When I was selling merchant services, I was against cash discount and credit card surcharge programs. I believed that this was a cost of business and the business should absorb the fees.

It wasn’t until my processor raised the rates on my merchants for the 6th time in 3 years that I got fed up.

I vented to my supervisor that…

“This feels wrong is was against what I offer to my merchants and not raising their rates”.

He explained that this is how the industry works and it is like this everywhere. Needless to say I was not satisfied with that.

But the good news is, it doesn’t have to be this way.

I plan to show you how a compliant cash discount program, or a compliant surcharge program, can do a lot of good.

- How the merchant benefits from a compliant cash discounting or compliant surcharging program

- The consumer really can benefit from such programs

- How

You’ll love this. Hear me out…

Before I go too far into detail, if you are a local business who learning about a compliant surcharge program, please leave a comment below. Write ”Yes“ if you are and “No” if you are not. You can write more, of course, we would love to see it. I want to use these results for a future guide.

The Ban of the Ban

I started to study why the US has some of the highest interchange in the world. Do you want to know what I found?

The US consumers appear to be the driving force. The reason interchange goes up, thus the reasons that prices increase.

The consumers want their rewards. Free miles. Cashback.

What the consumer fails to understand is that their Hawaiian Miles are not paid for by the airline. Their Disney reward points are not paid for by Disney. Someone has to pay for them, and it is always the merchant.

The rewards are generally paid for by the income from their interchange. The issuing banks are sharing their revenue to co-brand their card offering.

The card brands release their updates around the months of April and October. When they do these ”updates”, interchange rates tend to increase as well.

Often they market that some merchants will pay less interchange due to these updates. Yet, if we are being transparent, the majority is paying an increase in their rates.

Back in 2013, a big class-action lawsuit paved the way for a compliant surcharge programs. But, the rules and requirements to pass on the surcharge were complex unilateral on a state level.

This left almost a dozen states who then implemented a ban on credit card surcharging as a whole.

In 2010, the Durbin Amendment expanded on the Dodd-Frank law. Placing limits on transaction fees when using a credit or debit card to make purchases.

The Dodd-Frank Wall Street Reform and Consumer Protection Act, included wide-reaching financial reform in the wake of the 2008 financial crisis.

One of those limits being the ability to incentivize customers for cash payments.

“(2)(A) IN GENERAL.—A payment card network shall not, directly or through any agent, processor, or licensed member of the network, by contract, requirement, condition, penalty, or otherwise, inhibit the ability of any person to provide a discount or in- kind incentive for payment by the use of cash, checks, debit cards, or credit cards to the extent that—”…

Why interchange updates lead to higher prices for businesses and consumers

As stated above, the card brands tend to update their interchange rates twice per year.

Independent sales organizations (ISO’s), often raise their rates at the same time. They do this to piggyback of the messaging and to not raise attention that the ”updates” are separate.

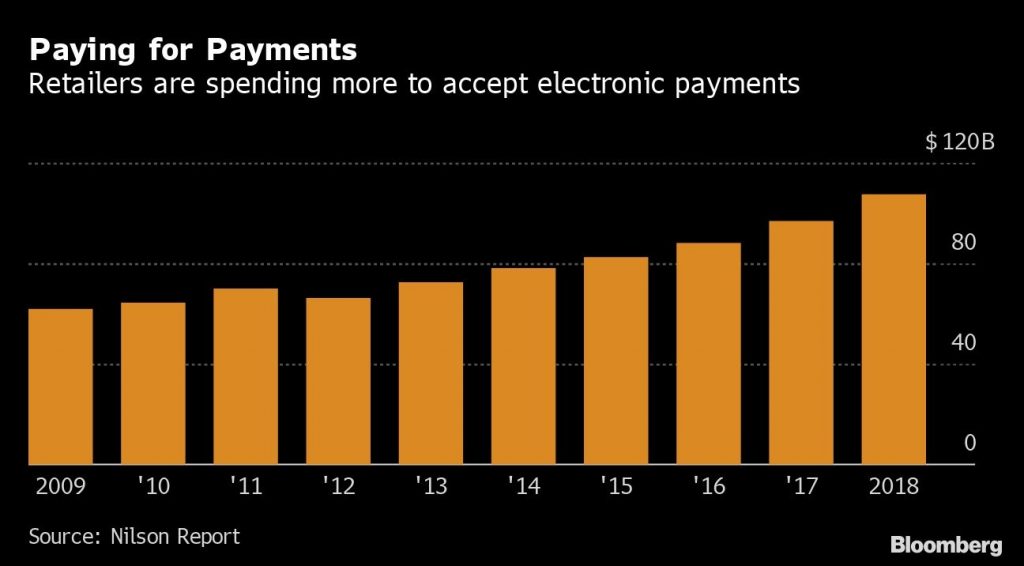

In fact, according to the Nilson Report, as of 2019, interchange rates were already 77% higher than it was in 2012.

Merchants often point at merchant services as being one of their highest business costs at an average of 3%.

More often than not, the business will have to raise prices to keep their lights on. This often causes small businesses to price themselves too high when compared with a big box or Amazon.

Let’s look at a quick example. Bob owns a local store where they sell modern, blue coffee cups in person and over their online store (I am not that creative, I write this while looking at my coffee cup, guess what color it is?). These coffee cups are $19.95. Amazon also has it for $19.95.

Bob doesn’t want his customers to go to Amazon as he loves serving his community. Bob uses Square to process his transactions. He likes that it is an easy rate to figure out (swiped 2.6% + $0.10, keyed rate $3.5% + $0.15).

Bob’s cost for the coffee mug is $17. Which gives him a 15% profit margin on the sale.

Bob get’s online orders from friends or referrals. In this case, he receives 1 order for 1 mug.

Forget about the regular costs of business such as insurance, power or employees. Look at this as one transaction and one cost. The cost of the mug is $17. The cost to run the transaction on Square is $0.75 (17 x .035 + .15).

This raises his cost to $17.75, and reduces his profit margin down to 11%. Because of this, his profit margin reduced by 27% after the transaction.

Now, if interchange goes up, Bob will increase his price or have to further reduce his profit margin.

If he increases his price, he will likely force many of his new prospects to go to Amazon. If he doesn’t, he will lose another 27% of his margin.

As these ”updates” tend to happen often, prices are in-turn increased at the retail level. Causing the consumer or business to pay a higher price.

With that, as interchange goes up, so do the prices that we all pay.

But do not worry, there are alternative solutions to this if we all work together.

Why the US has some of the highest interchange in the world

To some, it may not be surprising to find out that we have some of the highest interchange rates in the world.

Many would assume Australia, since they have some of the highest prices in the world. Especially for anything that is technology related.

But would you believe, Australia actually has some of the lowest interchange rates? Why is that?

For starters, in 2017 the Reserve Bank of Australia had announced an Interchange fee cap. This cap applies to domestic transactions for both consumer and commercial cards.

They also stated that interchange fees for credit cards won’t allow a fee to exceed 0.88%. And debit fees cannot exceed 16.5 cents (if levied as a fixed amount) or 0.22% (if levied as a percentage amount). These include Goods and Services Tax (GST).

Now, back in the US, in 2003, the merchants won a class-action lawsuit that changed everything. They were now able to pass the fees onto the customer as a surcharge. Before 2003, the card networks and brands had a strict ban on this. It is still banned in most parts of the world.

It started with a few locations, then more and more.

Fast forward to now, while we are seeing major changes due to the COVID-19 pandemic, change is rapid.

In many areas where surcharging is more common, it is day to day business. But the areas that do not have this program wide-spread, are in the perfect position to try this program out.

Consumers are watching their favorite restaurants and stores close their doors.

They are ordering food delivery by the same company that provides their taxi rides.

They are willing to pay more for the convenience or pay cash to support their community.

Back to Australia. with all the businesses who are surcharging, it was bound to make a few waves.

Because people were using their cards a bit less, the card brands had to do something. They weren’t going to sit and watch their record-breaking margins deteriorate.

Interchange, designed to incentivize banks and institutions to encourage credit card acceptance. Was now doing the opposite…

The merchants who pay for everyone’s cost and premium rewards were pushing back at the networks.

The only way to try and regain that share was to lower the interchange costs to the merchant.

“Since the Reserve Bank of Australia’s 2003 requirement, that the card brands remove the ‘no-surcharge’ rules that had previously been in effect, Australia has seen a significant increase in the number of businesses opting to pass on transaction costs, with approximately 42% of Australian businesses assessing transaction fees in 2013. The competition amongst the card brands in the wake of the changes has significantly reduced the interchange fees assessed to merchants”.

Up until 2013, it was not allowed to disclose what you paid on your merchant fees or to pass on a fee to a customer.

Now that we have this ability to offer a compliant surcharge program and to pass on the fees, we are seeing this catch on more and more.

Why surcharging and or cash discounting may hold the key to lower prices for everyone

We can all agree that the consumers are shooting themselves in the feet, right?

Let’s look at what we know:

- We know interchange went up over 77% over a 6 year period, during a time where there was an increase in card-holder reward offerings.

- We also know that one of the main reasons for an increase in interchange is to pay for the premium rewards.

- CreditCards.com did a survey and found that the average cash back rate on a card was 1% to 1.5%.

Since merchant services is one of the highest business expenses, as it goes up, so do prices.

Businesses need to decide to raise their prices or continue to see margin creep.

It is my opinion that the pursuit of premium rewards had caused the cost to outweigh the returned reward.

The difference between surcharging and cash discounting

If you search google for the difference, you get a snip-it from an eHopper.com article that states the following.

”The key difference between compliant surcharge programs and cash discounts is that with surcharges, you are adding a fee to credit card transactions, while with cash discounts, you are providing a discount off the advertised sales price when customers pay with cash.”

When a merchant has a compliant surcharge program, all prices reflect the ”cash price”. This allows them to market the lowest price and complete with some of the bigger box stores.

This means that when you walk up to a register with a $10 item, your new total will be $10.35 (assuming 3.5% compliant surcharge program).

A true cash discount, is where you give a discount for paying cash. The advertised price is the ”credit price”. This means if you walk up to that same register with a $10 item, your price will be $9.65 for cash (assuming a 3.5% cash discount).

A great example of this is gas stations. Do you remember when you could get a discount for paying with cash?

There is a small issue with the modern cash discount offering. Merchant services have figured out that they can advertise the cash price, state that at the register where a service fee is then added. If paying with cash, they will remove that service fee.

Visa and many other groups are not quite agreeing with this model. But due to the Derbin Amendment, it may be OK.

I will get back to that more on that on another post.

Back to why this is a good thing…

The benefits of a compliant surcharge program or cash discount program for the merchant

Ok, now it is a benefit for the merchant seems like a no brainer.

A compliant surcharge program allows the merchant to pass on the fees for credit transactions and remove that expense, right? Yes! There is more though.

Today, most retailers build int he cost of credit cards into their prices.

Let’s look at Bob again. Bob sells coffee mugs for $19.95.

We know you could get a similar mug from Amazon.com for a few pennies less.

But, now that surcharging is being implemented more often, Bob could remove that from his price. Allowing him to compete with other stores.

Another benefit is that Bob’s cash-paying customers are ecstatic because they are no longer paying to cover the cost of reward cards. It levels the playing field.

If a store, like most stores now, has a low profit margin on their products. This fee recovery could help increase the margin.

For example, if Bob’s coffee mug costs $18 after all expenses including card, and he is selling it for $19.95. This gives Bob a 10% profit margin.

If a fee recovery program was in full effect, he would now profit almost 13% which is a 30% increase in margin!

Here is the juicy part.

People ask me all the time:

“How can I lower my interchange costs”? Or “How can I get free credit card processing“?

My answer is simple:

“Stop taking credit cards”.

They always think I am joking. Of course if they do not take cards they won’t have to pay fees.

All joking aside, I recommend that they implement a compliant surcharge program and start to pass the high cost of credit card acceptance onto the customer.

I am saying if you take fewer cards, or if Bob down the street takes fewer cards, the card brands are going to incentives you to take more of cards…

How do they incentivize you? By lowering the interchange costs, of course!!!

This is exactly what happened in Australia and this is exactly what is going to happen in the United States.

Plus there is more benefits that we will cover later on. Let’s talk about how the consumer benefits from this.

How consumers benefit from this model

This is where it is a bit tricky for people to understand.

But the fact that you had the back story above, I am willing to bet that it is a lot easier to understand now.

By having a program that incentives for cash, consumers pay less for the goods or services they are buying.

They are also protecting themselves from future increases due to interchange updates.

They will invoke greater competition with the smaller retail and big box stores.

I imagine that the card issuers are going to get creative and find new rewards they can offer you. Rewards that are not funded by the merchant. Thus, lowering your costs even more at your favorite places of business.

Conclusion

There you have it! With a compliant surcharge program, it is a win/win! The merchants benefit by increasing their profit, lowering their costs, and by new marketing opportunities when it comes to competition.

Consumers benefit by gaining access to lower, and consistent pricing.

The quicker this happens, the quicker the country can take back control from the card brands.

If you haven’t already done taken a moment to compare the value and opportunity of a compliant surcharge program, or any other fee recovery program. I encourage you to do so.

Check with your processor to weigh out your options. If they can’t do it, let us know and we will help you find someone who will.

Do you like this post? Comment below and tell me if you agree or disagree that a fee recovery program could stop price increases due to interchange updates.